The SECURE Act 2.0 Has Taken Effect

Here’s What You Need to Know

Most changes from the SECURE Act 2.0 are set to go into effect in 2024 or later. We are here to guide you through those changes so adjustments can be made as necessary to help keep your long-term financial plan on track.

Below you will find a summary of the most significant changes. If you’d like a deeper dive, the Senate Finance Committee provided a 19 page summary.

Key Take Aways:

Required Minimum Distributions (RMD) Ages Adjust Again:

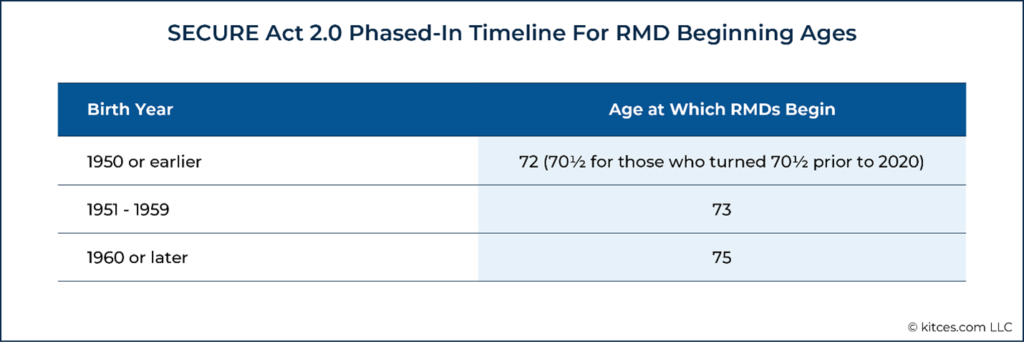

Yes, more dates to keep track of! See the table below to understand your RMD age going forward. If you were set to begin your RMDs in 2023, you get a one year delay and will begin RMDs in 2024.

*Note: the age to make a qualified charitable distribution (giving to charity directly from an IRA) stays the same at age 70.5.

Catch Up Contributions on 401(k)s, 403(b)s, and 457 Must Be to a ROTH for High Income Earners:

Starting in 2024, if you have wages in excess of $145,000 in the previous calendar year, any catch up contributions to your employer retirement savings account will be classified as ROTH contributions. This means these catch up contributions are not pre-tax savings on your income. It’s not all bad news though! ROTH contributions grow tax free and thanks for the SECURE ACT 2.0, ROTH contributions inside an employer retirement savings account no longer have a required minimum distribution.

What to do now: check with your employer if you earn more than $145,000/year to make sure they have the ROTH catch up option available. If they do not have a ROTH option available, you will not be able to make catch up contributions. Not all plans will have the ROTH option right now but there is a year to get things in order.

Moving unused 529 Plans dollars to a ROTH IRA – Effective 2024

The 529 change is getting a lot of attention. While we see this as a potential planning opportunity, it comes with quite a few restrictions that need to be considered.

- ROTH IRAs receiving funds from a 529 must be in the name of the beneficiary of the 529 plan

- 529 plan must have been in effect for 15 years or longer

- Any contributions made in the last 5 years and earnings on those contributions are not eligible to move to a ROTH IRA

- The annual limit on how much can be moved from 529 to ROTH is the same as the ROTH IRA contribution limit for that year ($6,500 for most in 2023). And no double dipping! (You can’t fund a ROTH IRA for $6,500 and do a 529 to ROTH transfer in the same year)

- The maximum amount that can be moved from 529 to ROTH during an individual’s lifetime is $35,000

- Can’t make a ROTH IRA contribution because your income is too high? It appears the 529 to ROTH option is still available for you regardless of income level.

Inheriting a Spouse’s IRA – Surviving Spouse Beneficiary Changes – Effective 2024

The SECURE ACT 2.0 allows for surviving spouses to be treated the same as the deceased spouse when it comes to taking Required Minimum Distributions (RMDs). This will matter the most for surviving spouses who are older than the deceased spouse as it will potentially allow for a delay in having to take RMDs.

Other Noteworthy Items in the Act:

- IRA catch up contributions will be indexed for inflation. The catch up contributions allow people age 50 and older to contribute an amount above the standard contribution limits. The catch up contribution limit has remained at $1,000 for 15 years. Starting in 2024, the catch up contribution limit will be adjusted for inflation, increasing in $100 increments.

- Increased Employer Retirement Plan (401(k), 403(b), etc.) Catch Up Contributions: starting in 2025, individuals ages 60, 61, 62, and 63 will have a higher catch up contribution limit than others. This limit will be $10,000 or 150%, whichever is greater, of the regular catch up contribution amount. With a 2023 catch up contribution limit of $7,500, this would make the catch up contribution for 60-63 year olds $11,250 if the change was in effect this year. And yes, if you have been paying attention, these catch up contributions must be in ROTH dollars. Why 60 – 63 year olds but not age 64 or above, your guess is as good as ours!

If you are a current client of Aspyre, we will be discussing how these tax law changes apply to your unique life in an upcoming meeting. You may have friends and family members who would benefit from this summary. Please forward this email to them!

Not a current client of Aspyre? Let us know if you need help in understanding how changes in laws with retirement planning might impact your life’s journey. We are available to meet with you.

Wondering what the SECURE ACT 1.0 was all about?

Jessi Chadd is a CERTIFIED FINANCIAL PLANNER professional and a member of Financial Planning Association of Greater Kansas City. She is a principal and chief wealth officer with Aspyre Wealth Partners® in Overland Park.