By Stewart Koesten

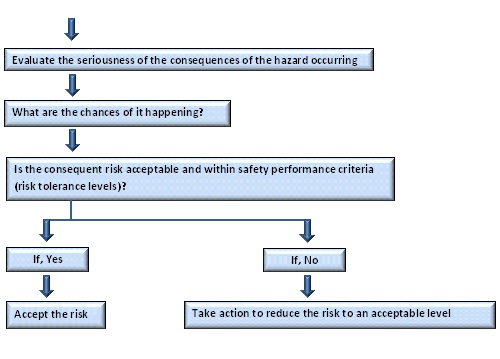

Here is an abbreviated model of a Risk Management Process:

Let’s look at a couple of example hazards we could apply this model to as it relates to our personal finances. Let’s start with identifying the hazard as a disabling illness or accident. How serious would the consequence be if a disabling illness or accident would occur? Perhaps you would drain your reserves and have to consume retirement savings or perhaps you would have no resources left at retirement. What are the chances of becoming permanently and totally disabled? Pretty low perhaps, but if the loss were to occur would you be able to manage through it? If so, then consider doing nothing, if not then perhaps take a serious look at disability insurance or some other options.

Let’s consider the risk associated with a stock market crash. Let’s say we have a crash like the one in 2008 that consumed about 40% of the value of an average stock portfolio. How serious would another major crash be to your plans? Could you survive it? If such an event were to occur would you have enough money to meet needs over the short term? Would such a loss affect other objectives like children’s education or your retirement? What are the chances of this happening? Well the probability is probably less now than just before 2008 but if the loss were to occur could you manage it? Is the risk acceptable and within your safety (risk tolerance) performance criteria? If so, then do nothing, and if not perhaps you’d increase the diversification of your investments assets and put fewer of your eggs in one basket.

Of course a part of any risk management process is an evaluation of the cost-benefit of the planned course of action. For example, if reducing stock market risk meant you might not achieve your long-term goals in the time frame you desire then another course of action might be considered.

Risk management tools can be an effective device to maintain a desired level of performance whatever the activity might be.

For help building risk management into your financial plan, schedule a meeting by clicking below, contact Stewart Koesten –skoesten@makinglifecount.com, or call (913) 345-1881.