NOTE: The Coronavirus Aid, Relief and Economic Security (CARES) Act passed by Congress and signed into law by the president on March 27, 2020, is an extensive document with more than 800 pages of text. We are breaking down many of the aspects of the Act which may be of interest to our clients and friends.

The CARES Act creates a temporary “universal charitable contribution” for the 2020 tax year. On next year’s taxes, taxpayers can deduct up to $300 in charitable donations from their taxable income. It must be a cash contribution and a direct contribution to a qualified charity, not a Donor Advised Fund.

Non-profit organizations represent a significant number of workers in the United States, with more than 12 million people employed and millions more in volunteer roles to operate charities, foundations, and other nonprofits.

Here are a few of the details we are covering with clients regarding this aspect of the Act.

1. This deduction is called a Qualified Charitable Contribution

This deduction is for cash gifts made to a non-profit, not to be confused with a Qualified Charitable Distribution. Generally, a qualified charitable distribution is an otherwise taxable distribution from an IRA (other than an ongoing SEP or SIMPLE IRA) owned by an individual who is age 70½ or over that is paid directly from the IRA to a qualified charity.

https://www.irs.gov/retirement-plans/retirement-plans-faqs-regarding-iras-distributions-withdrawals

2. Available to those who do not itemize

If you itemize and claim medical expenses, certain state and local taxes, sales or property taxes, mortgage loan interest, investment interest, tax preparation fees, unreimbursed employee expenses, other business expenses, this will not apply to you.

3. Limited to $300

Many Americans make charitable contributions in excess of $300, but only $300 will apply to the above-the-line deduction.

4. Must be made in cash

Unlike donations of gently worn clothing or qualified distributions, this benefit in the Act applies only to donations made in cash.

5. Must go to a 501(c)(3)

Organizations that qualify for 501(c)(3) status are commonly referred to as charitable organizations. These organizations may not attempt to influence legislation as a substantial part of its activities, and it may not participate in any campaign activity for or against political candidates. While many cash donations are made every year to donor-advised funds, those donations do not count toward the above-the-line charitable contribution deduction. Cash donations made to registered 501(c)(3) organizations are the only donations that qualify.

Reference: IRS website to check a charitable organization’s status https://www.irs.gov/charities-non-profits/tax-exempt-organization-search

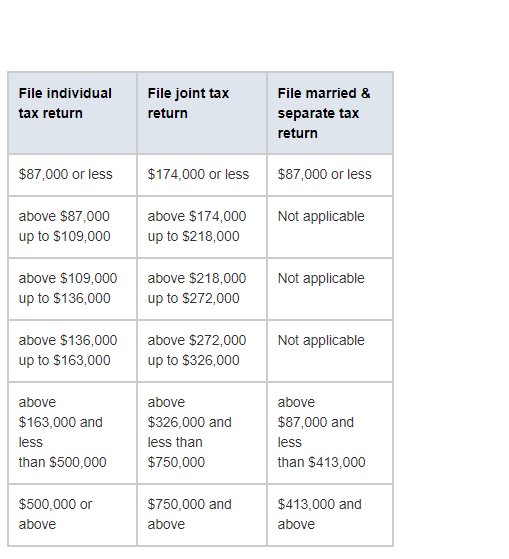

6. Could be good if pushing Medicare income limits

If you are close to reaching the top of a Medicare income bracket, this aspect of the Act may be of greater benefit to you. Below is a chart of income brackets for Medicare Part B monthly premiums. The deduction might help you from crossing over from one bracket to the next. Crossing into the next bracket can increase your healthcare costs.

About Aspyre Wealth Partners®

Being great at what we do is a core value at our firm. We specialize in helping successful people Master What’s Next®. We partner with you to define further success, and formulate strategies aligned with WHAT IS MOST IMPORTANT TO YOU. We really dig into the details so we can provide insights.

Collectively as a team we spent dozens of hours reviewing the various aspects of the CARES Act, as well as the recently-passed Families First Coronavirus Response Act. Our objective is to put our clients’ needs first, and to understand the benefits provided by these Acts, so our insights might resonate with what you need to know.

As a fiduciary, acting in our clients’ best interest is our first order of business. Aspyre Wealth Partners® is a Fee-Only firm, meaning we don’t earn commissions by selling insurance products to clients or by making trades on investments.

Angela Kreps leads commercial strategy for the firm, seeking to connect with new clients to define their goals, develop outcomes-based plans, and Master What’s Next®. Prior to joining Aspyre, she spent 30 years in executive leadership and business development roles, including 10 years as CEO of a bioscience organization.

If you are considering establishing a relationship with a financial advisor, please reach out or call (913) 345-1881, so we can schedule a conversation about how this and other aspects of recently-passed legislation might benefit you.

Reference:

Medicare Part B Premium Schedule